U.S. study reveals unusual volume of trades on New York and Tel Aviv stock exchanges which betted on Israeli stock market collapse a week before Hamas attack.

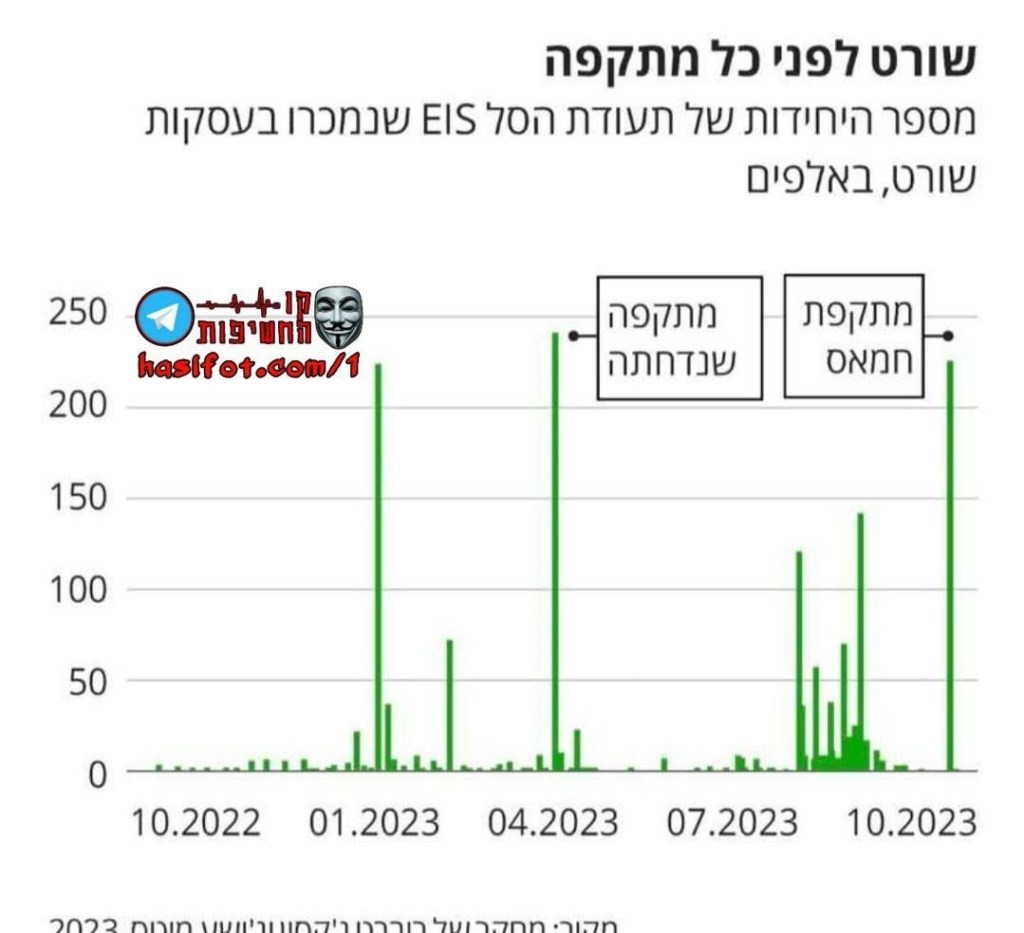

According to the researchers, The findings suggest that traders who knew about the impending attacks profited from the tragic events. On October 2, about a quarter of a million transactions that predicted a decline in Israeli stocks were conducted, compared with a few thousand per day in the previous month.

The study was conducted by two prominent American experts in the field of securities law: Prof. Robert Jackson of New York University, a former head of the U.S. Securities and Exchange Commission (SEC), and Prof. Joshua Mitts of Columbia University, an expert on short trades. They found that informed traders knew about the Hamas-led October 7 attack on Israel before it happened, and made massive profits on the U.S. and Israeli stock exchanges.

The researchers also examined the extent of such transactions carried out in the 15 years before Hamas attack. According to them, the volume of transactions carried out on October 2 was much greater than that occurred immediately after other major crisis events, including the recessions that followed the global financial crisis of 2008 and Covid-19 crisis.

A review of short trades carried out on the Tel Aviv Stock Exchange pointed to a significant increase on the eve of October 7. According to the researchers, this is an unusual activity which seems to have predicted a collapse in stock prices, difficult to explain by any reason other than prior knowledge of the attack.

According to the researchers, the comparative analysis shows that “it is highly unlikely that the extent of the short trades made on October 2 were random,” clearly implying that whoever was behind the move had prior knowledge.

The table: The huge increase in shorts selling in April 2023 might be explained by Hamas plan to carry out the attack on Passover, a plan which was postponed.

Zvi Gabbay, former Commissioner of Enforcement at the Israel Securities Authority strengthens the conjecture and explains that the amount of money invested in the move rules-out the possibility that it is an outcome of a high momentum of individuals. “This is not something that could be an outcome of association of individuals following some rumors.” he said. This type of activity by so-called ‘noise traders’ does not reach such heights. When I saw the trade volumes and the statistical significance, my jaw dropped. There’s no wave here, just a straight line.”

“The SEC has measures to investigate. They have legal authority to require the actors to give the information which would enable to find out who were behind them. I’d be surprised if it’s not shell companies, but it’s a lead.”

Our take: doubtful this kind of investigation will be carried out. The real culprits are highly protected.

Leave a comment